Welcome to this week's newsletter. Short week! Thanks Giving…

We had a relatively quiet week regarding the market front; the main headline would be Bitcoin to 100k... I personally play it through ETFs. Want to know more about the ETF market via crypto? and how you can use these ETFs as an inflationary hedge against Trump's tariffs - Subscribe to find out more.

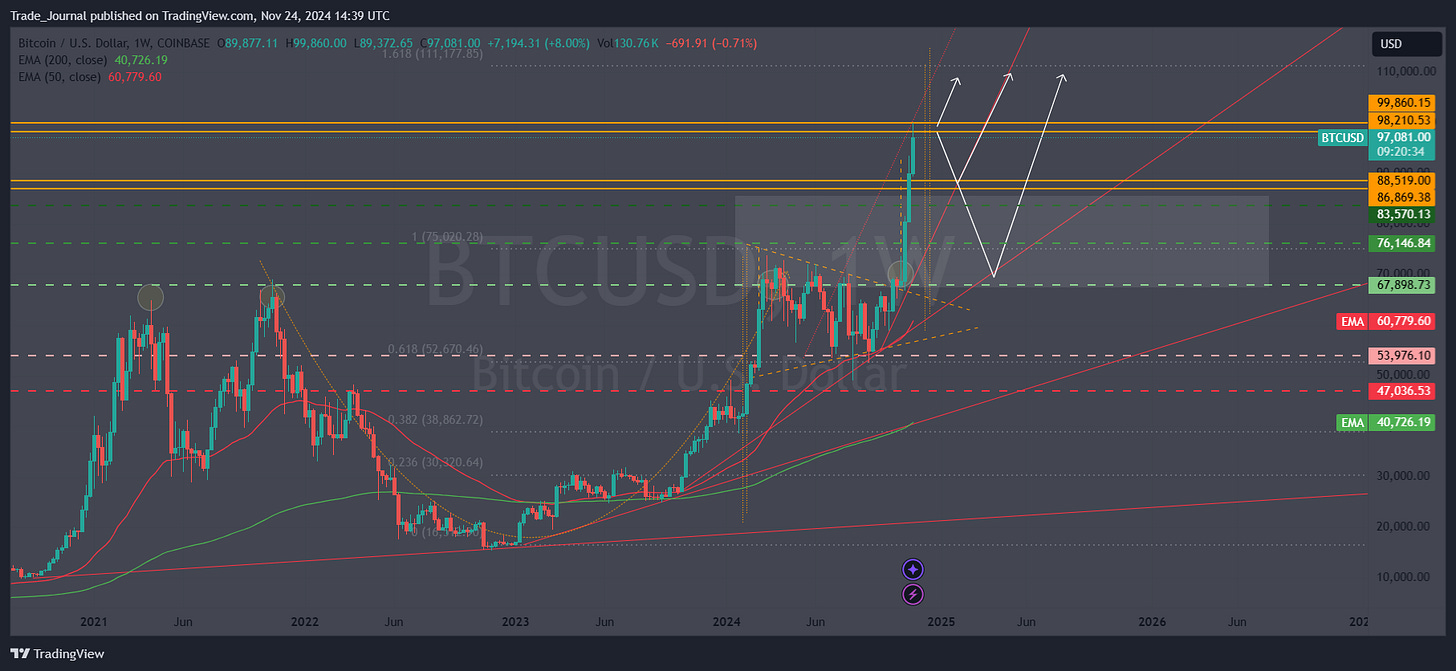

Bitcoin to 100k—What’s Trump's involvement in this, and is Bitcoin added to pension funds?

Technically where the price go to?

100 billion ETFs have surpassed its only been 10 months, very successful. Hedge funds are piling into this. Doesn’t it feel like the pump we had years ago or is it different this time? Now did you hear about the duck tape banana art work sold for triple amount 6.24 million for the piece of art on the wall. SEC 1st January ETFs - Institutions are in. 20th April Halving event (Every four years - mining reward has now halved for each block - Less reward) Less supply, less reward = PUMP and now Trump. He wants USA to be the forefront for Bitcoin. Regulation for bitcoin within USA will pump this higher. Also, we now have pension funds within these investments and this will be allocated likes of 1/2% it starts to pile into the price of Bitcoin. Dollar dependence drops, perhaps EM may have their own capital but have Bitcoin and could this also be the inflation hedge? Perhaps yes. That’s overall as why it’s pumped higher with all those points it makes sense. Lets go further into pension funds - ETFs. Hedge funds are doing the same direction. They see opportunities further but small level of exposure as it is a volatile instrument still 5% moves are very big. (Vanilla strategy = Pensions) Hedge funds would do L/S. Hedge funds trades are traders in which short term more than pension fund, but it would be the instrument would be leverage within instruments and gaining capital either side. Immature markets, but it is very volatile you seen doge that wouldn’t been part of pension fund or hedge fund - Maybe one day but the volume of trades are thin. It’s less liquid. As market matures that divergence, makes more volumes more liquid more hedge funds and most hedge funds use algo strategies time periods are very small that it would increase institutions further with less risk. Now if we want to go into Bitcoin pension funds - now futures lag when you get spot head higher = great opportunity for hedge fund traders = PROFIT. You could even do this via ETFs inverse. Bridge Water with state street and this could be connected further big funds with these other funds. This could be the start of something very special. Companies want exposure to these moves and those multi-strategy the return is very high due to big swings. Spot price and future market are two different components and the value is derived from the spot price future derivatives are. The quants would measure BETA and the correlation, say the instrument is higher correlated and what you’re looking for divergence it breaks so how do place the trade of the divergence for this moment of time? It’s L/S trade. Hedge - Fund. You’d buy spot and short futures. It’s simple as that. If your view is price of Bitcoin Spot vs Futures the spread has widened. How do you profit? At it widest the cheapest and short the highest prices = Profit. The outcome isn’t wanting 100k bitcoin, what matters it the spread widened and how it will narrow and that is called = HEDGED. It’s less risky trade and by placing trades like these are less risky and they are leveraged. Low risk but then reward is higher. Prime brokerage service hedge funds they finance they borrow capital for this trading outcomes which = low risk and high reward.

Now that doesn’t mean you jump into Bitcoin, its immature market still the moves will be ‘whacky’ with its behaviour. Trade/Invest safely.

Lets move onto inflationary hedge ETFs and various other funds - Most of it is priced in since summer. However, as Trump heads into office on the 20th January - changes are coming and some may be unexpected or not even activated to go forward. Don’t be worried about headlines, keep your political views aside. We are here to focus on the market solely.

TIPS it tracks the index of Treasury inflation protected securities. What does that mean? The value of the securities moves with movements in inflation. So as traders and investors TIPS can decline in price when inflation is rising but weaker than expected. (This could be helpful if Trump tariffs aren’t so bad perhaps TIPS could decline or rise if its not big issue)

(Technical of ETFs - Click the ticker)

If inflation was to tick higher commodities will increase back to prior:

Invesco DB Commodity Index Tracking Fund (DBC) (Cup & Handle/Wedge)

Now lets go into the dollar index - you must of heard of cash is king? As soon as Trump came in and within the summer we saw dollar slowly ticking higher. Now I think most of this is priced in within the dollar as we see here UUP 0.00%↑ one must check US trading partners and will he get the best deals - time will tell.

Invesco DB US Dollar Index Bullish Fund (UUP) (Resistance)

ETFs are really important component you can add to your portfolios especially within times like these with less risk but high rewards, you could go straight into L/S ETFs or simply go through optional viable route as well.

Lets dive into the technicals:

Futures:

Currency Futures:

DX1! - Dollar - Channel, At resistance - Wedge - 161.8 Retracement of Fib

6E1! - EUR - Channel, At support - Wedge - Completed 161.8 Retracement Fib

6B1! - GBP - Channel, Key Support - Wedge

US Futures Indices: Boom we head higher ES/NQ range - Small caps higher - sector rotation?

ES - Channel, Pennant - Key Support, Pennant

NQ - Channel, Key Support - Pennant

YM - Channel Resistance, Wedge break out/Flag

RTY - Channel, Wedge/Flag

Metal Futures: Break out opportunities

ETFs US Market - Sector Rotation

SPY - Channel - Pennant

QQQ - Channel - Pennant

IWM - Channel - Flag - At resistance

DIA - Channel - Flag - At resistance

US Industries

XME - S&P Metals & Mining ETF - Channel, Wedge **

VNQ - Vanguard Real Estate Index Fund ETF - Channel, Large Wedge/Double Bottom **

GDX - VanEck Gold Miners ETF - Channel, Pennant **

ITB - iShares US Home Construction ETF - Channel, Wedge **

OIH - VanEck Oil Services ETF - Channel, Range - Channel, Wedge**

KRE - SPDR S&P Regional Banking ETF - Channel, Wedge **

XRT - SPDR S&P Retail ETF - Channel, Flag - Range Resistance **

MOO - VanEck Agribusiness ETF - Channel, Range Resistance *

FDN - First Trust Dow Jones Internet Index Fund - Channel, Pennant **

IBB - iShares Biotechnology ETF - Channel, Pennant **

JETS - US Global Jets ETF- Channel, Wedge **

SMH- VanEck Semiconductor - Channel, Pennant ** - Key Support** ETF: SOXS - Bear X3 ETF - SOXL - Bull X3 ETF **

XOP - SPDR S&P Oil & Gas Exploration & Production ETF - Channel, Key Resistance *

KIE - SPDR S&P Insurance ETF - Channel, Pennant - Wedge/Flag **

PHO - Invesco Water Resources ETF - Channel, Pennant **

IGV - iShares Expanded Tech-Software Sector ETF - Channel, Pennant break out**

Equal Weight Sectors S&P:

RSP- Invesco S&P 500 Equal Weight - Channel, Pennant/Flag- Key Resistance **

RSPT - Technology - Channel, Wedge/Flag - Key Resistance **

RSPN- Industrials - Channel, Wedge break out/Flag - Key resistance**

RSPF - Financials - Channel, Wedge**

RSPD - Consumer discretionary - Channel, Pennant Break out - Key Resistance**

RSPG - Channel, Key Resistance **

RSPH - Health Care - Channel, Pennant **

RSPM - Material - Channel, Pennant **

RSPR - Real Estate- Channel, Wedge **

RSPC - Communication - Channel, Wedge**

RSPU - Channel, Wedge/Pennant**

Currency ETFs - Key support

UDN - Invesco DB US Dollar Index Bearish Fund - Channel, Key support

Real Estate ETFs - Break out brewing!

USRT - iShares Core US REIT ETF - Channel, Wedge **

IYR - iShares US Real Estate ETF - Channel, Wedge **

US food & beverage - Break outs brewing!

iShares U.S. Consumer Staples ETF - IYK - Channel, Wedge Break out - Key resistance **

First Trust Nasdaq Food & Beverage ETF - FTXG - Channel, Pennant **

Advisor Shares Restaurant ETF - EATZ - Channel, Wedge **

Invesco Food & Beverage ETF - PBJ - Channel, key resistance

Invesco DB Agriculture Fund - DBA - Channel, Wedge, break out**

Emerging Market ETFs -

EEM - iShares MSCI Emerging Markets ETF - Channel, Pennant **

EMQQ - Emerging Markets Internet & Ecommerce UCITS ETF - Channel, Pennant **

Fixed Income Sector - Posted via chat

MAG 7 ETFs - Range bound, focus on yields

MAGS - Roundhill Magnificent Seven ETF - Channel, Pennant/Wedge **

Stocks Mag 7’s - Posted via chat

Gaming Sector: - Break out brewing!

HERO - Global X Video Games & Esports ETF - Channel, Pennant **

BETZ - Roundhill Sports Betting & iGaming ETF - Channel, Wedge**

BJK - VanEck Gaming ETF - Channel, Wedge**

Commodities ETFs:

DBC - Invesco DB Commodity Index Tracking Fund - Channel, Pennant **

GSG - iShares S&P GSCI Commodity-Indexed Trust - Channel, Pennant **

USCI - United States Commodity Index Fund - Channel, Key Resistance *

COPX - Global X Copper Miners ETF- Rising - Channel, Pennant **

ICOP - iShares Copper and Metals Mining ETF - Channel, Pennant **

WOOD - iShares Global Timber & Forestry ETF - Channel. Pennant **

Have a wonderful week ahead,

Trade Journal | Empowering Your Trading Journey